In addition to the matters described in the proxy statement, we will report on the Company’s activities. Youactivities and you will have an opportunity to ask questions and to meet your directors and executives.questions.

James L. Dolan

MSG Networks Inc.

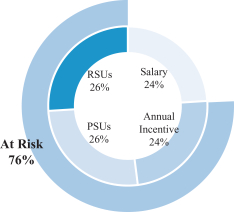

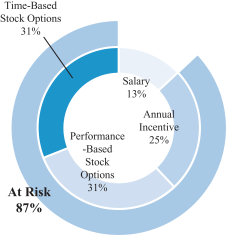

| (1) | For a full description of the bonus program for our NEOs, see “Compensation and Discussion and Analysis — Elements of Our Compensation Program — Annual Cash Incentives.” |

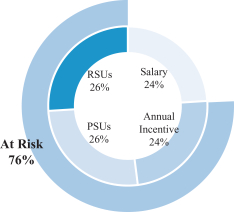

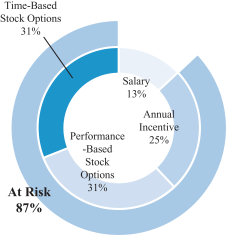

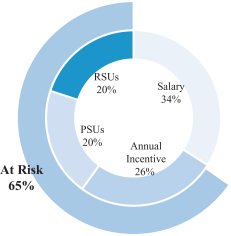

| (2) | As contemplated by his employment agreement, Mr. Dolan receives stock options in lieu of restricted stock units and performance stock units. Half of the stock options are subject to |

| performance-based vesting conditions, with the same performance conditions that are used for performance stock units; half of the stock options are subject to time-based vesting, with the same vesting schedule that is used for restricted stock units. |

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 11, 20157, 2017

GENERAL INFORMATION

Questions and Answers You May Have About our Annual Meeting and VotingCOMPANY OVERVIEW

These proxy materials are provided in connection with the solicitation of proxies by the Board of Directors of MSG Networks Inc. for the Annual Meeting of Stockholders to be held at 10:00 a.m. Eastern Time on Friday, December 11, 2015, at The Paley Center for Media which is located at 25 West 52nd Street, New York, NY.

In this proxy statement, the words “Company,” “we,” “us,” “our” and “MSG Networks” refer to

MSG Networks Inc., a Delaware corporation. We refer to the U.S. Securitiescorporation, is a holding company and Exchange Commission as the “SEC” andconducts substantially all of its operations through its subsidiaries. Our Class A Common Stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “MSGN.” As a result, we are subject to certain of the NYSE corporate governance listing standards.

The Company was incorporated on July 29, 2009 as “NYSE.” This proxy statement and forman indirect, wholly-owned subsidiary of proxy are first being sent to stockholders on or about October 28, 2015. Unless otherwise indicated, references to “2015,”Cablevision Systems Corporation (“Cablevision”). On February 9, 2010, Cablevision spun off the “2015 fiscal year”Company (the “Cablevision Distribution”) and the “year ended June 30, 2015” refer toCompany acquired the Company’s fiscal year ended on June 30, 2015.subsidiaries of Cablevision that owned, directly and indirectly, all of the partnership interests in MSG Holdings, L.P.

MSG Networks was formerly known as “The Madison Square Garden Company.” We changed our name to MSG Networks Inc. on September 30, 2015 (the “MSG Distribution Date”) in connection with the distribution of all of the outstanding common stock of MSG Spinco, Inc. (now known as “TheThe Madison Square Garden Company”Company and referred to herein as “MSG”) to our stockholders (the “MSG Distribution”). Pursuant to the MSG Distribution, MSG acquired the entertainment and sports businesses previously owned and operated by the Company through its MSG Entertainment and MSG Sports business segments, including the arenas and other venues previously owned, leased or operated by the Company as well as the Company’s interests in various joint ventures.

PROXY STATEMENT MATERIALS

These proxy materials are provided in connection with the solicitation of proxies by our Board for the Annual Meeting of Stockholders to be held at 10:00 a.m. Eastern Time on Thursday, December 7, 2017, at The Paley Center for Media, which is located at 25 West 52nd Street, New York, NY.

In this Proxy Statement, the words “Company,” “we,” “us,” “our” and “MSG Networks” refer to MSG Networks Inc., a Delaware corporation. This Proxy Statement is being sent to stockholders on or about October 27, 2017. Unless otherwise indicated, references to “2017,” the “2017 fiscal year” and the “year ended June 30, 2017” refer to the Company’s fiscal year ended on June 30, 2017.

QUESTIONSAND ANSWERS YOU MAY HAVE ABOUT OUR ANNUAL MEETINGAND VOTING

Who may vote at the annual meeting?

Holders of our Class A common stock, par value $0.01 per share (“Class A Common StockStock”) and holders of our Class B common stock, par value $0.01 per share (“Class B Common Stock,” together with Class A Common Stock, collectively, “Company Stock”) as recorded in our stock register at the close of business on October 21, 2015,13, 2017, may vote at the meeting. On October 21, 2015,13, 2017, there were 61,192,67461,648,035 shares of Class A Common Stock and 13,588,555 shares of Class B Common Stock outstanding. Each share of Class A Common Stock has one vote per share and holders will be voting for

the election of three candidates to the Board of Directors of the Company (the “Board”).Board. Each share of Class B Common Stock has ten votes per share and holders will be voting for the election of eightnine candidates to the Board. As a result of their ownership of all of the shares of our Class B Common Stock, members of the Charles F. Dolan members of his family and certain related family entities, have the power to elect all of the directors to be elected by the holders of our Class B Common Stock, and to approve Proposals 2, 3 4 and 54 regardless of how other shares are voted.

Why did I receive a Notice of Annual Meeting and Internet Availability of Proxy Materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC,U.S. Securities and Exchange Commission (the “SEC”), the Company has elected to provide access to its proxy materials over theby Internet. Accordingly, the Company has sent a Notice of Annual Meeting and Internet Availability of Proxy Materials to our stockholders. All stockholders have the ability to access the proxy materials on the website referred to in the Notice of Annual Meeting and Internet Availability of Proxy Materials or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over theby Internet or to request a printed copy may be found in

the Notice of Annual Meeting and Internet Availability of Proxy Materials. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically. If you previously chose to receive our proxy materials electronically, you will continue to receive access to these materials via email unless you otherwise elect. The Company encourages stockholders who have not already done so to take advantage of the availability of the proxy materials on the Internet to help reduce the cost and the environmental impact of the annual meeting.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Wells Fargo Shareowner Services, you are considered a stockholder of record with respect to those shares, and the Notice of Annual Meeting and Internet Availability of Proxy Materials was sent directly to you by the Company. If you request printed copies of the proxy materials by mail, you will also receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm,

bank, broker-dealer or other similar organization, then you are a beneficial owner of shares held in “street name,” and the Notice of Annual Meeting and Internet Availability of Proxy Materials was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to instruct that organization how to vote the shares held in your account. If you requested printed copies of the proxy materials by mail, you will receive a voting instruction form from that organization.

What is a quorum?votes need to be present to hold the annual meeting?

In order to carry on the business of the annual meeting, we must have a quorum. This means that at leastneed a majority of the votes represented by the outstanding shares eligible to vote muston October 13, 2017 to be represented at the meeting, eitherpresent, in person or by proxy or in person.proxy. This is known as a “quorum.” If voting on a particular matter

action is by class, a majority of the votes represented by the outstanding shares of such class constitutes a quorum for thatsuch action. Abstentions and broker non-votes count(described below) are considered present for the purposepurposes of determining a quorum.

How do I vote?

You may vote in advance of the annual meeting by telephone, over the Internet or mail by mail.following the instructions provided on the Notice of Annual Meeting and Internet Availability of Proxy Materials. If you choose to vote by mail, please sign, date and return the proxy card in the postage-paid envelope

provided. You may also vote in person or by legal proxy at the meeting. Even if you plan to attend the annual meeting in person, the Board strongly recommends that you submit a proxy to vote your shares in advance so that your vote will be counted if you later decide not to attend the annual meeting. You may submit your proxy in favor of your Board’s recommendation by telephone, over the Internet or by mailing a proxy card by following the instructions provided on the Notice of Annual Meeting and Internet Availability of Proxy Materials. If you choose to vote by mail, please sign, date and return the proxy card in the postage-paid envelope provided.

Can my broker vote my shares without instructions from me?

If you are a beneficial owner whose shares are held of record by a broker,brokerage firm, bank, broker-dealer or other similar organization, you must instruct your broker them

how to vote your shares.Please use the voting instruction form provided to you by your brokerbrokerage firm, bank, broker-dealer or other

similar organization to direct the brokerthem how to vote your shares. If you do not provide votinginstructions, your shares will not be voted on theelection of directors or any other proposal on which the brokerbrokerage firm, bank, broker-dealer or other similar organization does not have discretionary authority to vote.This is called a “broker non-vote.” In these cases, the brokerbrokerage firm, bank, broker-dealer or other similar organization can register your shares as being present at the annual meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under applicable rules.

If you are a beneficial owner whose shares are held of record by a broker,brokerage firm, bank, broker-dealer or

other similar organization, your brokerbrokerage firm, bank, broker-dealer or other similar organization has discretionary voting authority under applicable rules to vote your shares on the ratification of the appointment of KPMG LLP (“KPMG”) as the Company’s independent auditors (Proposal 2), even if the brokerbrokerage firm, bank, broker-dealer or other similar organization does not receive voting instructions from you. However, your brokerbrokerage firm, bank, broker-dealer or other similar organization does not have discretionary authority to vote on the (i) election of directors (Proposal 1) or (ii) approval of the Company’s 2010 Employee Stock Plan, as amended, (iii) approval of the Company’s 2010 Cash Incentive Plan, as amended or (iv) approval of the Company’s 2010 Stock Plan for Non-Employee Directors, as amended,advisory votes with respect to named executive officer compensation (Proposals 3 and 4) without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

What is the voting requirement to approve each of the proposals?

Election of directors by the holders of our Class A Common Stock requires the affirmative vote of the plurality of votes cast by holders of our Class A Common Stock. Election of directors by the holders of our Class B

Common Stock requires the affirmative vote of the plurality of votes cast by holders of our Class B Common Stock. Approval of Proposals 2, 3 4 and 54 require the favorable vote of a majority of the votes cast by the holders of our Class A Common Stock and the holders of our Class B Common Stock, voting together as a single

class. Abstentions and broker non-votes will not affect the outcome of the proposals because abstentions and broker non-votes are not considered votes cast. As a result of their ownership of all of the shares of our Class B Common Stock, members of the Charles F. Dolan members of his family and certain related family entities have the power to elect all of the directors to be elected by the holders of our Class B Common Stock and to approve Proposals 2, 3 4 and 54 regardless of how other shares are voted. Proposals 3 and 4 are advisory votes only and are not binding on the Company.

Can I change my vote after I have voted?

Yes. If you are a stockholder of record, you may revoke your proxy and change your vote at any time before the final vote at the annual meeting. You may change your vote prior to the annual meeting by:

re-voting your shares via theby Internet or by telephone by following the instructions on the Notice of Annual Meeting and Internet Availability of Proxy Materials or proxy card (only your latest Internet or telephone proxy submitted prior to the annual meeting will be counted);

signing and returning a valid proxy card or voting instruction form with a later date;

delivering a written notice of revocation to the Company’s Secretary at 11 Pennsylvania Plaza, New York, NY 10001; or

attending the annual meeting and voting in person (but your attendance at the annual meeting will not automatically revoke your proxy unless you validly vote again at the annual meeting).

If your shares are held in a brokerage account by a broker, you should follow the instructions provided by your broker in order to change your vote.

How will my shares be voted at the annual meeting if I submit a proxy card?

The proxy materials, including the proxy card, are being solicited on behalf of yourthe Board. The Company representatives appointed by the Board (the persons named inon the proxy card, or, if applicable, their substitutes) will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your shares will be voted as the Board recommends, which is:

FOR the election of each of the Director nominees named in this proxy statement (Proposal 1);

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending June 30, 20162018 (Proposal 2);

FOR the approval, on an advisory basis, of the Company’s 2010 Employee Stock Plan, as amendedcompensation of our NEOs (Proposal 3);

FOR the approval of the Company’s 2010 Cash Incentive Plan, as amended (Proposal 4); and

FOR, on an advisory basis, future advisory votes on the approval the Company’s 2010 Stock Plan for Non-Employee Directors, as amendedcompensation of our NEOs to be held every three years (Proposal 5)4).

Who participates in and pays for this solicitation?

The Company will bear the expense of preparing, printing and mailing this proxy statement and the accompanying material.materials. Solicitation of individual stockholders may be made by mail, personal interviews, telephone, facsimile, electronic delivery or other telecommunications by our executive officers and regular employees who will receive no additional compensation for such activities.

We have retained D.F. King & Co,Co., Inc. to assist with the solicitation of proxies for a fee estimated not to exceed $20,000, plus reimbursement for out-of-pocket expenses. In addition, we will reimburse brokers and other nominees for their expenses in forwarding solicitation material to beneficial owners.

How do I attend the 2015 Annual Meeting2017 annual meeting in person and what identification must I show?

An admission ticket will be required if you desireplan to attend the annual meeting in person. To be admitted to the 20152017 annual meeting, you must have been a stockholder at the close of business on the record date of

October 21, 201513, 2017 or be the legal proxy holder or qualified representative of such stockholder. You must bring with you your admission ticket and a valid government-issued photo identification card (federal, state or local), such as a driver’s license or passport. Persons without an admission ticket and proper identification may be denied admission to the annual meeting. Registration will begin at 9:00 a.m. Eastern Time on the annual meeting date.

To obtain an admission ticket, go towww.proxyvote.com or call 1-844-318-0137 (toll-free) or 925-331-6070 (international). You will need to enter your 12-digit16-digit control number, which can be found on your Notice of Annual Meeting and Internet Availability of Proxy Materials, voting instruction form or proxy card. You may also request an admission ticket by calling the telephone number on your voting instruction form or proxy card. The deadline to obtain an admission ticket is 5:00 p.m. on December 1, 2015.November 30, 2017. If you have questions about

admission to the annual meeting, please call1-844-318-0137 (toll-free) or 925-331-6070 (international).

Please note that you will need your admission ticket to be admitted to the meeting whether you vote before or at the meeting, and regardless of whether you are a registered or beneficial stockholder. If you are attending the meeting as a proxy or qualified representative for a stockholder, you will need to bring your legal proxy or authorization letterin addition to your admission ticket and government-issued photo identification card.

Stockholders must provide advance written notice to the Company if they intend to have a legal proxy (other than the persons appointed as proxies on the Company’s proxy card) or a qualified representative attend the annual meeting on their behalf. The notice must include the name and address of the legal proxy or qualified representative and must be received by 5:00 p.m. on December 1, 2015November 30, 2017 in order to allow enough time for the issuance of an admission ticket to such person. For further details, read “Advancesee “Other — Advance Notice of Proxy Holders and Qualified Representatives” on page 92 of this proxy statement.Representatives.”

Please note that cameras, video and audio recording equipment and other similar electronic devices, as well as large bags (including largebackpacks, handbags and briefcases) and packages will need to be checked at the door. Additionally, the Company may impose

additional restrictions on items that must be checked at the door. To ensure the safety of all persons, attendees and bags may also be subject to security inspections.

What is “householding” and how does it affect me?

Stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials may receive only one copy of this Notice of Annual Meeting and Proxy Statement and Annual Report on Form 10-K for the fiscal year ended June 30, 20152017 (the “2015“2017 Form 10-K”) unless we are notified that one or more of these stockholders wishes to receive individual copies. This “householding” procedure will reduce our printing costs and postage fees.

Stockholders who participate in householding will continue to receive separate proxy cards. If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of this Notice of Annual Meeting and Proxy Statement and any accompanying documents, or if you hold MSG Networks stock in more than one account, and, in either case, you wish to receive only a single copy of each of these documents for your household, please

contact our transfer agent, Wells Fargo Shareowner Services, P.O. Box 64874, St. Paul, MN 55164-0854Broadridge Householding Department, by calling their toll free number, 1-866-540-7095, or by telephone at 1-800-468-9716.writing to: Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717.

If you participate in householding and wish to receive a separate copy of this Notice of Annual Meeting and Proxy Statement and any accompanying documents, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact Wells Fargo Shareowner ServicesBroadridge Householding Department as indicated above. You will be removed from the householding program within 30 days of receipt of your instructions, at which time you will then be sent separate copies of the documents.

If you are a beneficial owner, you can request information about householding from your broker, bank or other holder of record.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 11, 20157, 2017.

This Notice of Annual Meeting and Proxy Statement, the proxy card and the Company’s 20152017 Form 10-K, along with directionsinstructions on how to obtain an admission ticket to attend the annual meeting in person, are available at www.viewproxymaterials.com/msg. www.proxyvote.com.

In accordance with the SEC rules, of the SEC, we are using the Internet as our primary means of furnishing proxy materials to our stockholders. Consequently, most of our stockholders will not receive paper copies of our proxy materials. WeInstead we are instead sending these stockholders a Notice of Annual Meeting and Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our proxy statement and annual report,2017 Form 10-K, and voting via theby Internet. The Notice of Annual Meeting and Internet

Availability of Proxy Materials also provides information on how our stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly, and helps conserve natural resources. If you previously elected to receive our proxy materials electronically, these materials will continue to be sent via email unless you change your election.

If you receive paper copies of our proxy materials and would like to sign up for electronic delivery via email or the Internet, please choose one offollow the following methodsinstructions to make your request:vote by Internet at www.proxyvote.com and, when prompted, indicate that you agree to receive or access stockholder communications electronically in future years.

BOARD AND GOVERNANCE PRACTICES

OVERVIEW

| | | | |

(1) | | By Internet: | | www.proxyvote.com |

(2) | | By Telephone: | | 1-800-579-1639 |

(3) | | By Email: | | sendmaterial@proxyvote.com |

CORPORATE GOVERNANCE

MSG Networks is a holding company and conducts substantially allThe following section provides an overview of its operations through its subsidiaries. Our Class A Common Stock is listed on NYSE under the symbol “MSGN.” As a result, we are generally subject to NYSEour Board and corporate governance listing standards.practices.

The Company was incorporated on July 29, 2009 as an indirect, wholly-owned subsidiarySince the spin-off of Cablevision Systems Corporation (“Cablevision”). On January 12, 2010, Cablevision’s board of directors approved the distribution of all of the outstanding common stock of the Company to Cablevision stockholders (the “Cablevision Distribution”) and the Company thereafter acquired the subsidiaries of Cablevision that owned, directly and indirectly, all of the partnership interests in MSG Holdings, L.P. The Cablevision Distribution took place on February 9, 2010 (the “Cablevision Distribution Date”).

MSG Networks was formerly known as “The Madison Square Garden Company.” On September 11, 2015, our Board approved the MSG Distribution and MSG thereafter acquired the entertainment and sports businesses previously ownedinto a separate publicly traded company (The Madison Square Garden Company) in

September 2015, we have taken several actions to be responsive to stockholder feedback, including expanding our stockholder outreach efforts and operated by the Company through its MSG Entertainment and MSG Sports business segments, including the arenas and other venues previously owned, leased or operated by the Company as well as the Company’s interests in various joint ventures. The MSG Distribution took place on September 30, 2015 (the “MSG Distribution Date”) and we changedenhancing our nameproxy disclosure to MSG Networks Inc. on that date in connection with the MSG Distribution.provide greater transparency to our stockholders.

Corporate Governance GuidelinesCORPORATE GOVERNANCE PRACTICES

Our Board has adopted Corporatethe Governance Guidelines. These guidelinesGuidelines and other practices to promote the functioning of the Board and its committees to serve the best interests of all our stockholders. The Governance Guidelines provide a framework for our governance practices, including:

| ✓ | Annual election of directors, with all directors serving one-year terms |

| ✓ | Board composition to include a broad range of skills, experience, industry knowledge, diversity of opinion and contacts relevant to the Company’s business that serves the interests of the holders of both our Class A Common Stock and Class B Common Stock |

| ✓ | Board self-assessments conducted at least annually to assess the mix of skills and experience that directors bring to the Board to facilitate an effective oversight function |

| ✓ | Robust director nomination criteria to ensure a diversity of viewpoints, background and expertise in the boardroom |

| ✓ | Regular executive sessions of independent directors |

| ✓ | Independent Board committees, with each of the Audit Committee and the Compensation Committee comprised 100% of independent directors |

| ✓ | Restricted stock units subject to holding requirement through the end of service on the Board |

Our Governance Guidelines set forth our practices and policies with respect to Board composition and selection, Board meetings, executive sessions of the Board, Board committees, the expectations we have of our directors, selection of the Executive Chairman and the President and Chief Executive Officer, management succession, Board and executive compensation, and Board self-evaluationself-assessment requirements. The full text of our Corporate Governance Guidelines may be viewed at our corporate website at www.msgnetworks.com. www.msgnetworks.com under Investors — Corporate Governance. A copy may be obtained by writing to MSG Networks Inc., 11 Pennsylvania Plaza, New York, NY 10001; Attention: Corporate Secretary.

STOCKHOLDER ENGAGEMENT

Fostering long-term relationships with our stockholders is a priority for the Company. Engagement helps us gain insight into the issues most important to our stockholders, informing Board discussions and allowing us to consider investors’ views on a range of topics including corporate governance and executive compensation matters.

During the 2017 fiscal year, we engaged with holders of approximately 75% of our Class A Common Stock concerning our Board, governance and executive compensation practices, with the specific goal of seeking stockholder feedback. We greatly value the views of our stockholders, and look forward to continuing this dialogue.

BOARD LEADERSHIP STRUCTURE

Our Board has chosen to separate the roles of Executive SessionsChairman and President and Chief Executive Officer. The Board believes that this is the optimal leadership structure as it recognizes both Mr. James L. Dolan’s senior executive role with the Company as well as his leadership position on the

Company’s Board while the Company is also able to benefit from the experience of Non-Managementits President and IndependentChief Executive Officer, Ms. Andrea Greenberg, with responsibility for day-to-day management of the Company.

BOARD SELF-ASSESSMENT

The Board Membersconducts an annual self-assessment to determine whether the Board and its committees are functioning effectively. Among other things, the Board’s self-assessment seeks input from the directors on whether they have the tools and access necessary to perform their oversight function as well as

suggestions for improvement of the Board’s functioning. In addition, our Audit Committee and Compensation Committee each conducts its own annual self-assessment, which includes an assessment of the adequacy of their performance as compared to their respective charters.

EXECUTIVE SESSIONSOF NON-MANAGEMENTAND INDEPENDENT BOARD MEMBERS

Under our Corporate Governance Guidelines, our directors who are not also executive officers of our Company (“non-management(the “non-management directors”) or our directors who are independent under the NYSE rules are required to meet regularly in executive sessions with no members of management present. If non-managementnon-

management directors who are not independent participate in these executive sessions, the independent directors under the NYSE rules are required to meet separately in executive sessions at least once each year.

CommunicatingRISK OVERSIGHT

Our Board believes that risk oversight is an important Board responsibility. The Audit Committee takes the lead on behalf of the Board in this risk oversight role. The Audit Committee discusses guidelines and policies governing the process by which the Company’s management assesses and manages the Company’s exposure to risk, and discusses the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures. The Compensation Committee considers the Company’s exposure to risk in establishing and implementing our executive compensation program. The Compensation Committee, with Our Directorsthe assistance of its independent

compensation consultant, reviewed the level of risk incentivized by the Company’s executive compensation program as well as incentive programs below the executive level. Based on this assessment and the executive compensation program’s emphasis on long-term performance, its close connection to Company-wide performance and its equity-based component designed to align the executive officers’ compensation with the Company’s long-term strategy and growth, the Compensation Committee determined that our executive compensation program does not create incentives for excessive risk-taking that are reasonably likely to have a material adverse effect on the Company.

COMMUNICATINGWITH OUR DIRECTORS

Our Board has adopted policies designed to allow our stockholders and other interested parties to communicate with our directors. Any interested party thatwho wishes to communicate directly with the Board or any director or the non-management directors as a group should send communications in writing to the Chairman of the Audit Committee, MSG Networks Inc., 11 Pennsylvania Plaza, New York, NY 10001.

Any person, whether or not an employee, who has a concern with respect to our accounting, internal accounting controls, auditing issues or other matters, may, in a confidential or anonymous manner, communicate those concerns to our Audit Committee by contacting The Network Inc.,the MSG Networks Integrity Hotline, which has been designated to act asis operated by a confidential contact organization for these purposes,third-party service provider, at 1-877-756-4306.1-844-761-0392.

Code of Conduct and Ethics

CODEOF CONDUCTAND ETHICS

Our Board has adopted a Code of Conduct and Ethics for our directors, officers and employees. A portion of this Code of Conduct and Ethics also serves as a code of conduct and ethics for our senior financial officers, including our principal accounting officer and controller. Among other things, our Code of Conduct and Ethics covers conflicts of interest, disclosure responsibilities, legal compliance, reporting and compliance with the Code of Conduct and Ethics,

confidentiality, corporate opportunities, fair dealing, protection and proper use of Company assets and equal employment opportunity and harassment. The full text of the Code of Conduct and Ethics is available on our website at www.msgnetworks.com. www.msgnetworks.com. In addition, a copy may be obtained by writing to MSG Networks Inc., 11 Pennsylvania Plaza, New York, NY 10001; Attention: Corporate Secretary.

Director IndependenceDIRECTOR INDEPENDENCE

Our

As a “controlled company” we have the right to elect not to comply with the corporate governance rules of the NYSE requiring: (i) a majority of independent directors on our Board, has elected for the Company to be treated(ii) an independent corporate governance and nominating committee, and (iii) an independent compensation committee. Because of our status as a “controlled company” under NYSE’swe have elected not to maintain a majority of independent directors on our Board or to have a corporate governance rules, and as a result, the Company is not required to comply, and has chosen not tonominating committee. We comply with NYSE’s requirement for a majority independent board of directors and for an independent nominating committee. However, our Board has elected to comply with NYSE’sthe requirement for an independent compensation committee.

Richard D. Parsons, Nelson Peltz and Scott M. Sperling, eachOur Board elected not to comply with the requirement for a majority of whom were independent directors on our Board because of our voting structure. Under the terms of our Amended and Restated Certificate of Incorporation, as amended (“Certificate of Incorporation”), the holders of the Company elected byCompany’s Class A stockholders duringB Common Stock have the 2015 fiscal year, and Alan D. Schwartz and Vincent Tese, both of whom were independent directorsright to elect up to 75% of the Company elected by Class B stockholders during the 2015 fiscal year, resigned asmembers of our Board and there is no

requirement that any of those directors of the Company and became directors of MSG on September 30, 2015 in connection with the MSG Distribution.be independent or be chosen independently.

Mr. Sykes was appointed as a director of the Company elected by Class A stockholders on August 5, 2015 and Messrs. DeMark and Litvin were appointed as directors of the Company elected by Class A stockholders on September 30, 2015 in connection with the MSG Distribution. Messrs. DeMark, Litvin and Sykes are each being nominated for election by Class A stockholders at the annual meeting. Our Board believes that the Company and its stockholders will benefit from the combination of fresh perspectives provided by these independent directors, as well as their collective deep business expertise.

OurHowever, our Board has determined that each of the following non-employee directors andClass A director nominees is “independent” within the meaning of the rules of the NYSE and the SEC: Eugene F. DeMark,Joseph J. Lhota, Joel M. Litvin and John L. Sykes. In reaching its independence determination, with respect to Mr. DeMark, the Board considered the

following:fact thatMr. Lhota served as an audit partner at KPMG.Executive Vice President of the Company from 2010 to 2011 but he worked on Cablevision’s audit from 1995 through 2006 and that Mr. DeMark has had no relationship with KPMGthe Company since September 2010.2011. Mr. Lhota is also nominated for election as a director of MSG at MSG’s 2017 annual meeting of stockholders. The Board determined that such past relationship isthese relationships are not material to the Company and that Mr. DeMarkLhota is independent within the meaning of the rules of NYSE and the SEC. In reaching its independence determination with respect to Mr. Litvin, the Board considered the fact that Mr. Litvin was previously employed by the National Basketball Association and that he may provide limited consulting services to the National Basketball Association. The Board determined that such past employment and any limited consulting services are not material to the Company and that Mr. Litvin is independent within the meaning of the rules of NYSE and the SEC.

In addition, Charles P. Dolan

DIRECTOR NOMINATIONS

As permitted under the NYSE rules, we do not have a nominating committee and Kristin A. Dolan also resignedbelieve it is appropriate not to have one because of our stockholder voting structure. The Board nonetheless has established a nomination mechanism in our Corporate Governance Guidelines for the selection of nominees for election as directors elected by the holders of our Class A Common Stock (“Class A Directors”) and by the holders of our Class B stockholders and became directorsCommon Stock (“Class B Directors”). Nominees for election as Class A Directors are

recommended to the Board by a majority of MSG on September 30, 2015the independent Class A Directors then in connection with the MSG Distribution. Effectiveoffice. Nominees for election as of that date,Class B Directors are recommended to our Board appointed William J. Bell, Quentin F. Dolan, Paul J. Dolan and Hank J. Ratner as directors elected by Class B stockholders.

We welcome the combined insighta majority of our new directors as we continue to pursue our strategies to create long-term shareholder value.

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board has nominated 12 director candidates named below. Of the 12 nominees for director, three are to be elected by the Class A stockholders and nine are to be elected by the Class B stockholders. All 12 director candidates are hereby nominated for a term to expire at the 2016 annual meetingDirectors then in office. Our Certificate of Incorporation provides holders of the Company’s stockholders and until their successors have been elected and qualified.

The persons named onClass B Common Stock the proxy card intendright to vote for the election of eachelect up to 75% of the director nominees below proposed by the Board of Directors, unless you indicate on your proxy that your vote should be withheld from any or all of the nominees. Information on eachmembers of our nominees is given below.

Each director nominee listed below has consented to being named in this proxy statementBoard and has agreed to serve if elected. However, if a nominee for election as a director by the Class A stockholders becomes unavailable before the election or for good cause will not serve, the persons named in the Class A proxy on the proxy card would be authorized to vote for a replacement nominee for election as a director by the Class A stockholders if the Board names one. If a nominee for election as a director by the Class B stockholder becomes unavailable before the election or for good cause will not serve, the persons named in the Class B proxy would be authorized to vote for a replacement Class B director nominee if the Board names one.

The Board unanimously recommends that you vote FOR eachholders of the following candidates:

Director Nominees for Election byour Class A Common Stockholders

EUGENE F. DEMARK — Age 68

Director since September 30, 2015

Mr. DeMark was a senior partner of KPMG, LLP, a global professional services firm, where he worked from July 1969 until his retirement in October 2009. He served asStock the Area Managing Partner of KPMG’s Northeast Advisory Practice from October 2005 until his retirement and previously held various other leadership roles during his tenure at KPMG. Between 1988 and 2001, Mr. DeMark had been the Northeast Area Managing Partnerright to elect 25% of the Information, Communications and Entertainment Practice and the Managing Partner of KPMG’s Long Island Office. During his career at KPMG, Mr. DeMark had responsibilities to lead a number of specialized practices in banking, high technology, media and entertainment and aerospace and defense. Since his retirement, Mr. DeMark has worked as an independent consultant. Mr. DeMark serves as a director of BankUnited, Inc., Florida’s largest independent bank, since September 2010 and is the Lead Director as well as Chair of the Audit and Risk Committee. Mr. DeMark also serves as a director of 1-800-FLOWERS.COM, Inc., a national floral and gifting company, since January 2012 and is Chair of the Audit Committee. Mr. DeMark is a Certified Public Accountant in the State of New York and is a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants. Mr. DeMark is an executive board member and the Finance Chairman of the Board of Overseers of the Tilles Center for Performing Arts and previously served as Chairman and President of Long Island chapters of the Multiple Sclerosis Society and the Boy Scouts of America. Mr. DeMark’s qualifications to serve on our Board include his 40 years of business experience with a leading professional services firm, his experience with clients in the media and entertainment industries, his financial, accounting and risk management expertise, his service as a director of other public companies and his leadership roles at charitable institutions.

JOEL M. LITVIN — Age 56

Director since September 30, 2015

Mr. Litvin was the President, League Operations of the National Basketball Association (the “NBA”) from 2006 until his retirement on September 1, 2015. As the NBA’s President, League Operations, he managed several core areas of the day-to-day operations of the NBA, including the league’s security, player development,

social responsibility and legal functions. Mr. Litvin also managed, on behalf of the NBA Board of Governors, franchise matters such as revenue sharing, team sales and financings, relocations and the NBA’s ownership and debt policies. Mr. Litvin initially joined the NBA as a staff attorney in 1988 and also served as Senior Vice President and General Counsel from 1999 to 2000 and Executive Vice President, Legal and Business Affairs from 2000 to 2006. Mr. Litvin began his professional career at the New York law firm of Willkie Farr & Gallagher, where he worked on several matters for Major League Baseball. Mr. Litvin previously served as a member of the Board of Governors of the Naismith Basketball Hall of Fame and expects to shortly begin serving as a member of its Board of Trustees. Mr. Litvin’s qualifications to serve on our Board include his more than 27 years of business experience at the NBA (including as the chief NBA league office liaison to the NBA Board of Governors), his extensive knowledge about the sports and sports media businesses, his management and legal expertise, and his service on the board of a charitable institution.

JOHN L. SYKES — Age 60

Director since August 5, 2015

Mr. Sykes is the President of Entertainment Enterprises for iHeartMedia, Inc. (formerly CC Media Holdings, Inc.), a global media and entertainment company, since January 2012. In his role at iHeartMedia, Mr. Sykes is responsible for developing new business partnerships and platforms across a range of media, including broadcast television, digital video platforms and live events, as well as creating value for iHeartMedia’s advertisers and key partners. Mr. Sykes is the co-executive producer of six annual iHeartRadio live events that are broadcast on network television. Mr. Sykes also worked with iHeartMedia in a consulting role during 2011. Prior to joining iHeartMedia, Mr. Sykes was affiliated with the Pilot Group, a private equity and venture firm, from 2008 to 2011. Mr. Sykes was a core member of the team that launched MTV Networks in 1981. During his more than 20 year tenure at Viacom, Inc., Mr. Sykes served as President of New Network Development for MTV from 2005 to 2008, Chairman and CEO of Infinity Broadcasting Corporation (now CBS Radio) from 2002 to 2005 and President of the VH1 Cable Television Network from 1994 to 2002. Mr. Sykes also serves on the boards of Shazam Mobile, the Robin Hood Foundation, the Rock and Roll Hall of Fame, VH1 Save the Music and Syracuse University’s Newhouse School of Communications. Mr. Sykes’s qualifications to serve on our Board include his 35 years of business and management experience, his extensive experience in the media, television and entertainment industries and his service on the boards of other companies and charitable institutions.

Director Nominees for Election by Class B Common Stockholders

JAMES L. DOLAN — Age 60

Director since July 29, 2009

Mr. Dolan is Executive Chairman of the Company since July 29, 2009. He also assumed the responsibilities of the President and Chief Executive Officer of the Company from March 15, 2015 to July 15, 2015. He was Chairman of MSG Holdings, L.P. from 1999 to 2010. Mr. Dolan is the Executive Chairman of MSG since March 2015. Mr. Dolan is Chief Executive Officer of Cablevision since October 1995. He was President of Cablevision from June 1998 to April 2014; Chief Executive Officer of Rainbow Media Holdings, Inc., a former subsidiary of Cablevision, from September 1992 to October 1995; and Vice President of Cablevision from 1987 to September 1992. Mr. Dolan serves as a director of Cablevision, AMC Networks and MSG. James L. Dolan is the son of Charles F. Dolan, the father of Quentin F. Dolan, the brother of Thomas C. Dolan, the brother-in-law of Brian G. Sweeney, and the cousin of Paul J. Dolan. In light of his experience in various positions with Cablevision since 1979, including as its Chief Executive Officer since 1995, his experience in various positions with the Company and its predecessors since 1999, including most recently as its Chairman since 1999 (and Executive Chairman since 2009), as well as the knowledge and experience he has gained about the Company’s business and contributions he has made during his tenure as a director of the Company, Cablevision, AMC Networks and MSG, our Board has concluded that James L. Dolan should serve as a director of the Company.

CHARLES F. DOLAN — Age 88

Director since July 29, 2009

Mr. Dolan is Chairman of Cablevision since 1985. He was Chief Executive Officer of Cablevision from 1985 to October 1995. He is Executive Chairman of AMC Networks since June 2011. Mr. Dolan founded and acted as the General Partner of Cablevision’s predecessor from 1973 to 1985 and established Manhattan Cable Television in 1961 and Home Box Office in 1971. Mr. Dolan serves as a director of Cablevision, AMC Networks and MSG. Charles F. Dolan is the father of James L. Dolan and Thomas C. Dolan, father-in-law of Brian G. Sweeney, the grandfather of Quentin F. Dolan, and the uncle of Paul J. Dolan. In light of his experience in the cable television and cable programming industries, as well as his experience as founder of Cablevision, his service as Chairman and, previously, as the Chief Executive Officer of Cablevision and its predecessors, as well as the knowledge and experience he has gained about the Company’s business and contributions he has made during his tenure as a director of the Company, Cablevision AMC Networks and MSG, our Board has concluded that Charles F. Dolan should serve as a director of the Company.

WILLIAM J. BELL — Age 75

Director since September 30, 2015

Mr. Bell was a consultant to Cablevision Systems Corporation from 2005 to 2014. Mr. Bell also held various positions at Cablevision and its predecessor beginning in 1979, including as Cablevision’s Vice Chairman and Chief Financial Officer until 2004. Mr. Bell is a director of AMC Networks since June 2011. Mr. Bell also serves as a director of the Lustgarten Foundation. In light of Mr. Bell’s broad experience in the cable and programming industries for the past 40 years, as well his experience in various positions with Cablevision and its predecessor since 1979, including as its former Vice Chairman and Chief Financial Officer, our Board has concluded that William J. Bell should serve as a director of the Company.

PAUL J. DOLAN — Age 57

Director since September 30, 2015

Mr. Dolan is the Chairman and Chief Executive Officer of the Cleveland Indians Major League Baseball (MLB) team since 2010. Mr. Dolan was President of the Cleveland Indians from 2004 to 2010 and Vice President and General Counsel from 2000 to 2004. Mr. Dolan has served on multiple committees of the MLB and is currently on the MLB’s Long Range Planning Committee and Ownership Committee. Mr. Dolan has been a director and member of the Compensation Committee of the J.M. Smucker Company since 2006. Mr. Dolan also serves as a director of Cablevision and Dix & Eaton, a privately owned communications and public relations firm. Mr. Dolan was Chairman and Chief Executive Officer of Fast Ball Sports Productions, a sports media company, from 2006 through 2012. Paul J. Dolan is the nephew of Charles F. Dolan, a cousin by marriage of Brian G. Sweeney, and the cousin of James L. Dolan, Thomas C. Dolan and Quentin F. Dolan. In light of his extensive business and management experience in the sports and media industries, his experience as a member of Cablevision’s founding family, the knowledge and experience he has gained about the Company’s business and the contributions he has made during his tenure as a director of Cablevision, and his service on the board of another public company, our Board has concluded that Thomas C. Dolan should serve as a director of the Company.

QUENTIN F. DOLAN — Age 21

Director since September 30, 2015

Mr. Dolan is a student at New York University. Mr. Dolan has held internship positions at Grubman Shire & Meiselas, P.C. and Azoff MSG Entertainment LLC. Quentin F. Dolan is the son of James L. Dolan, the grandson of Charles F. Dolan, the nephew of Thomas C. Dolan and Brian G. Sweeney, and the cousin of Paul J. Dolan. In light of his familiarity with the business and being a member of the third generation of Cablevision’s founding family, our Board has concluded that Quentin F. Dolan should serve as a director of the Company.

THOMAS C. DOLAN — Age 63

Director since February 9, 2010

Mr. Dolan is Executive Vice President, Strategy and Development, Office of the Chairman of Cablevision since September 2008. He was Chief Executive Officer of Rainbow Media Corp. from April 2004 to April 2005; Executive Vice President and Chief Information Officer of Cablevision from October 2001 until April 2005; Senior Vice President and Chief Information Officer of Cablevision from February 1996 to October 2001; Vice President and Chief Information Officer of Cablevision from July 1994 to February 1996; General Manager of Cablevision’s East End Long Island cable system from November 1991 to July 1994 and System Manager of Cablevision’s East End Long Island cable system from August 1987 to October 1991. Mr. Dolan serves as a director of Cablevision, AMC Networks and MSG. Thomas C. Dolan is the son of Charles F. Dolan, the brother of James L. Dolan, the brother-in-law of Brian G. Sweeney, the uncle of Quentin F. Dolan, and the cousin of Paul J. Dolan. In light of his experience as a member of Cablevision’s founding family and in various positions with Cablevision since 1987, as well as the knowledge and experience he has gained about the Company’s business and contributions he has made during his tenure as a director of the Company, Cablevision, AMC Networks and MSG, our Board has concluded that Thomas C. Dolan should serve as a director of the Company.

WILT HILDENBRAND — Age 67

Director since November 30, 2011

Mr. Hildenbrand is a Senior Advisor Customer Care, Technology and Networks for Cablevision since January 2013. He was Senior Advisor of Engineering and Technology from March 2006 to January 2013; Executive Vice President of Engineering and Technology from January 2000 to March 2006; Senior Vice President of Technology from January 1998 to January 2000 and Vice President of Engineering Support and Customer Relations from October 1986 to January 1998. He served as Director of Engineering for Rainbow Media Holdings, a former subsidiary of Cablevision, from July 1979 to October 1986. Mr. Hildenbrand serves as a director of MSG since September 30, 2015. In light of his experience in various positions at Cablevision since 1979 and his familiarity with the Company and MSG, our Board has concluded that Wilt Hildebrand should serve as a director of the Company.

HANK J. RATNER — Age 56

Director since September 30, 2015

Mr. Ratner is the Vice Chairman of Cablevision since December 2002. Mr. Ratner previously served as Vice Chairman of MSG from February 2014 until January 2015, and President and Chief Executive Officer of MSG from July 2009 to February 2014. Mr. Ratner was Vice Chairman of Rainbow Media (the name of AMC Networks while it was a subsidiary of Cablevision) from June 2002 to June 2011; a director of Rainbow Media from April 1997 to September 2003; Chief Operating Officer of Rainbow Media from October 1999 to June 2002; Chief Operating Officer and Secretary of Rainbow Media from October 1998 to October 1999; Executive Vice President & Secretary of Rainbow Media from October 1997 to October 1998; and Executive Vice President, Legal & Business Affairs and Secretary of Rainbow Media from July 1993 to October 1997. Mr. Ratner serves as a director of the Garden of Dreams Foundation. In light of his experience in various positions with the Company and its predecessors since 1993, including as the Company’s Vice Chairman and President and Chief Executive Officer, and the knowledge and experience he has gained about the Company’s business and contributions he has made during his tenure as vice chairman of the Company and Cablevision, our Board has concluded that Hank J. Ratner should serve as a director of the Company.

BRIAN G. SWEENEY — Age 51

Director since February 9, 2010

Mr. Sweeney is the President of Cablevision since April 2014 and the Chief Financial Officer of Cablevision since March 2015. He was Senior Executive Vice President, Strategy and Chief of Staff of Cablevision from January 2013 to April 2014; Senior Vice President — Strategic Software Solutions of

Cablevision from June 2012 to January 2013; and Senior Vice President — eMedia of Cablevision from January 2000 to June 2012. Mr. Sweeney serves as a director of Cablevision, AMC Networks and MSG. Brian G. Sweeney is the son-in-law of Charles F. Dolan, the brother-in-law of James L. Dolan and Thomas C. Dolan, the uncle of Quentin F. Dolan, and the cousin by marriage of Paul J. Dolan. In light of his experience in various positions with Cablevision since 1993, as well as the knowledge and experience he has gained about the Company’s business and contributions he has made during his tenure as a director of the Company, Cablevision, AMC Networks and MSG, our Board has concluded that Brian G. Sweeney should serve as a director of the Company.

BOARD OF DIRECTORS

Term of Office and Attendance at Board Meetings

The term of officemembers of our directors will expire at the annual meeting of stockholders on December 11, 2015, at which time our stockholders will vote onBoard.

DIRECTOR SELECTION

Our Board believes that each director’s re-election for a term to expire at the annual meeting of the Company’s stockholders in 2016 and once their successors have been elected and qualified. See “Proposal 1 — Election of Directors.” The business address for each director is c/o MSG Networks Inc., 11 Pennsylvania Plaza, New York, NY 10001. Each director is a citizen of the United States. We encourage our directors to attend annual meetings of stockholders and believe that attendance at annual meetings is just as important as attendance at meetings of the Board. Three of the five incumbent directors who were on the Board during the 2015 fiscal year attended the 2014 annual stockholders meeting.

The Board met ten times during the fiscal year ended June 30, 2015 and all of the directors who were on the Board during such time attended at least 75% of the meetings of the Board and, as applicable, the committees of the Board on which he or she served.

Director Selection

Our directors have not set specific, minimum qualifications that nominees must meet in order for them to be nominated for election to the Board, but rather believe that each nominee should be evaluated based on the skills needed on the Board and his or her individual merits, taking into account, among other matters, the factors set forth in our Corporate Governance Guidelines under “Board Composition” and “Selection of Directors.” Those factors include:

The desire to have a Board that encompasses a broad range of skills, expertise, industry knowledge, diversity of viewpoints, opinions, background and experience and contacts relevant to our business;

Personal qualities and characteristics, accomplishments and reputation in the business community;

Ability and willingness to commit adequate time to Board and committee matters; and

The fit of the individual’s skill and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of our Company.

The Class A Directors will evaluate possibleand recommend Class A Director candidates to recommend to the Board for nomination as Class A Directors and suggest

individuals for the Board to explore in more depth. The Board also considers nominees for Class A DirectorsDirector nominees recommended by our stockholders. Nominees recommended by our stockholders are given appropriate consideration in the same manner as other nominees. Stockholders who wish to submit nominees for consideration by the Board for election at our 20162018 annual meeting of our stockholders may do so by submitting in writing such nominees’ names, in compliance with the procedures and along with other information required by the Company’s Amended By-laws. See “Other Matters—Matters — Stockholder Proposals for 20162018 Annual Meeting.”

The Class B Directors will consult from time to time with one or more of the holders of our Class B Common Stock to assureensure that all Class B Director nominees recommended to the Board are individuals who will make a meaningful contribution as Board members and will be individuals likely to receive the approving vote of the holders of a majority of the outstanding Class B Common Stock. The Class B Directors do not intend to consider unsolicited suggestions of nominees by holders of our Class A Common Stock. We believe that this is appropriate in light of the voting provisions of our Amended and Restated Certificate of Incorporation which vest exclusively inprovides the holders of our Class B Common Stock the exclusive right to elect our Class B Directors.

BOARD MEETINGS

The Board Leadership Structuremet four times during the fiscal year ended June 30, 2017 and all of the directors who were on the Board during such time attended at least 75% of the meetings of the Board and, as applicable, the committees of the Board on which he or she served.

We encourage our directors to attend annual meetings of our stockholders and believe that attendance at annual meetings is equally as important as attendance at Board and committee meetings. All of the directors, except one, attended the 2016 annual stockholders’ meeting.

COMMITTEES

Our board has two standing committees comprised solely of independent directors: the Audit Committee and the Compensation Committee.

Audit Committee

Members: Messrs. Lhota (Chair), Litvin and Sykes

Meetings during fiscal year ended June 30, 2017: 4

The primary purposes and responsibilities of our Audit Committee are to:

assist the Board in (i) its oversight of the integrity of our financial statements, (ii) its

| | oversight of our compliance with legal and regulatory requirements, (iii) assessing our independent registered public accounting firm’s qualifications and independence, and (iv) assessing the performance of our internal audit function and independent registered public accounting firm; |

appoint, compensate, retain and oversee the Company’s registered public accounting firm and pre-approve, or adopt appropriate procedures to pre-approve, all audit and non-audit services, if any, to be provided by the independent registered public accounting firm;

review and coordinate the agenda, scope, priorities, plan and authority of the internal audit function (which is currently provided through services from MSG);

establish procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and for the confidential, anonymous submission by Company employees or any provider of accounting-related services of concerns regarding questionable accounting and auditing matters and review of submissions and treatment of any such complaints;

review and approve related party transactions that are required to be disclosed under SEC rules or that require such approval under the Company’s Related Party Transaction Approval Policy;

conduct and review with the Board an annual self-assessment of the Audit Committee;

prepare any report of the Audit Committee required by the rules and regulations of the SEC for inclusion in our annual proxy statement;

review and reassess the Audit Committee charter at least annually; and

report to the Board on a regular basis.

Our Board has determined that each member of our Audit Committee is “independent” within the meaning of the rules of both the NYSE and the SEC, and that each has not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years and is able to read and understand fundamental financial statements, including balance sheets, income statements and cash flow statements. Our Board has also determined that Mr. Lhota is an “audit committee financial expert” within the meaning of the rules of the SEC.

Our Board has chosenestablished a procedure whereby complaints or concerns with respect to separateaccounting, internal controls, auditing and other matters may be submitted to the rolesAudit Committee. This procedure is described under “Board and Governance Practices — Communicating with Our Directors.”

The text of Chairmanour Audit Committee charter is available on our website at www.msgnetworks.com under Investors — Corporate Governance. A copy may be obtained by writing to MSG Networks Inc., Corporate Secretary, 11 Pennsylvania Plaza, New York, NY 10001.

Compensation Committee

Members: Messrs. Lhota, Litvin and Sykes (Chair)

Meetings during fiscal year ended June 30, 2017: 10

The primary purposes and responsibilities of our Compensation Committee are to:

establish our general compensation philosophy and, in consultation with management, oversee the Boarddevelopment and Chief Executive Officer. The Board believes that this isimplementation of compensation programs;

review and approve corporate goals and objectives relevant to the optimal leadership structure as it recognizes both Mr. James L. Dolan’s senior executive role with the Company as well as his leadership position on the Company’s Board while the Company is also able to benefit from the experiencecompensation of itsour President and Chief Executive Officer Ms. Andrea Greenberg, with responsibility for day-to-day management of the Company.

Risk Oversight

The Company’s Board believes that risk oversight is an important Board responsibility. The Audit Committee takes the lead on behalf of the Board in this risk oversight role. The Audit Committee discusses guidelines and policies governing the process by which the Company’s management assesses and manages the Company’s exposure to risk, and discusses the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures. The Compensation Committee considers the Company’s exposure to risk in establishing and implementing our other executive compensation programs. The Compensation Committee, with the assistance of its independent compensation consultant, reviewed the level of risk incentivized by the Company’s executive compensation program as well as incentive programs below the executive level. Based on this assessment and the executive compensation program’s emphasis on long-term performance, its close connection to Company-wide and divisional performance and its equity-based component designed to align the executives’ compensation with the Company’s long-term strategy and growth, the Compensation Committee determined that our executive compensation programs do not create incentives for excessive risk-taking that are reasonably likely to have a material adverse effect on the Company.

Director Compensation

Each non-employee director receives a base fee of $50,000 per year; $2,000 per Board or committee meeting attended in person; and $500 per Board, committee or non-management director meeting attended by telephone. Non-employee directors also receive $10,000 annually per committee chairmanship or $5,000 annually per committee membership. In addition, we reimburse our directors for reasonable expenses in connection with attendance at Board, committee and stockholder meetings. A directorofficers who is a Company employee receives no compensation for serving as a director.

We also pay our non-employee directors compensation in restricted stock units. On the day of the annual stockholder’s meeting, each non-employee director receives an annual grant of restricted stock units for the number of shares of common stock equal to $110,000 based on the average closing price over the twenty trading day period concluding on the previous day. The restricted stock units the non-employee directors receive are fully vested on the date of grant.

Our non-employee directors are required to hold all such restricted stock units untilfile reports with the first business day following 90 days after service onSEC under Section 16 of the Board ceases (other thanSecurities Exchange Act of 1934, as amended (the “Exchange Act”) (together with the President and Chief Executive Officer, the “Senior Employees”), evaluate the Senior Employees’ performance in light of these goals and objectives and determine and approve their compensation based upon that evaluation;

approve any new equity compensation plan or material changes to an existing plan;

oversee the eventactivities of a director’s death), at which time they are settled the committee or committees administering our retirement and benefit plans;

in stock, or at the Compensation Committee’s election, in cash. Suchconsultation with management, oversee regulatory compliance with respect to compensation is made pursuant tomatters, including overseeing the Company’s 2010 Stock Planpolicies on structuring compensation programs to preserve tax deductibility, and, as and when required, establishing performance goals and certifying that performance goals have been attained for Non-Employee Directors,purposes of Section 162(m) of the Internal Revenue Code, as amended. In connection with the MSG Distribution, each holder of a director restricted stock unit received one share of MSG Class A Common Stock in respect of every three restricted stock units owned on the record dateamended (the “Code”);

determine and continuesapprove any severance or similar termination payments to be entitledmade to a shareSenior Employees (current or former);

determine the components and amount of our Class A Common Stock (or cash or other property) in accordance with the award agreement.

Historically, in order for our directors to develop an intimate familiarity with the different types of events presented at our venues, the servicesBoard compensation and support offered to patrons at our events and the characteristics and features of our venues, the Company has made available to each of our non-employee directors without charge up to two tickets per event for up to eight events per calendar year, subject to availability. Director attendance atreview such events had been integrally and directly related to the performance of their duties and, as such, we did not deem the receipt of such tickets to be perquisites. These ticket limitations did not apply to special events to which non-employee directors and their guests may have been specifically inviteddeterminations from time to time in relation to other similarly situated companies;

prepare any reports of the Compensation Committee to be included in the Company’s annual proxy statement in accordance with the applicable rules and regulations of the SEC;

conduct and review with the Board an annual self-assessment of the Compensation Committee; and

report to the Board on a regular basis, but not less than annually.

The Compensation Committee reviews the performance of the Senior Employees, evaluates their capacityperformance in light of those goals and objectives and, either as non-employeea committee or together with any other

independent directors (as directed by the Board) determines and approves the Senior Employees’ compensation level based on this evaluation. In determining the long-term incentive component of our President and Chief Executive Officer’s compensation, the Compensation Committee considers, among other factors, the Company’s performance and relative stockholder return, the value of similar incentive awards to Chief Executive Officers at comparable companies and the awards given to the President and Chief Executive Officer in past years. As discussed above, our Board has determined that each member of our Compensation Committee is “independent” under the rules of the NYSE.

The Compensation Committee may, in its discretion, delegate a portion of its duties and responsibilities to one or more subcommittees of the Compensation Committee. For example, the Compensation Committee may delegate the approval of certain transactions to a subcommittee consisting solely of members of the Compensation Committee who are (i) “non-employee directors” for the purposes of Rule 16b-3 of the Exchange Act, and (ii) “outside directors” for the purposes of Section 162(m) of the Code (“Section 162(m)”). The Compensation Committee has delegated the approval of certain Section 162(m)-related compensation decisions relating to granting, and determining the level of performance under, performance-based compensation to a subcommittee comprised of Messrs. Litvin and Sykes. The Compensation Committee may also engage outside compensation consultants to assist in the performance of its duties and responsibilities.

The text of our Compensation Committee charter is available on our website at www.msgnetworks.com. A copy may be obtained by writing to MSG Networks Inc., Corporate Secretary, 11 Pennsylvania Plaza, New York, NY 10001.

Compensation Committee Interlocks and Insider Participation

Messrs. Lhota, Litvin and Sykes serve as members of the Compensation Committee. Neither Mr. Litvin nor Mr. Sykes is a current or a former executive officer or

employee of the Company. Mr. Lhota was an employee of the Company (e.g., charity concerts, premieres, etc.). from June 2, 2010 to November 9, 2011.

Independent Committee

In addition non-employee directors had been able to purchase tickets to events fromstanding committees, the Company at face value, subjecthas adopted a policy whereby a committee of our Board

consisting entirely of independent directors (an “Independent Committee”) will review and approve

or take such other action as it may deem appropriate with respect to availability. Tickets provided to directors were not available for resale. Effective astransactions involving the Company and its subsidiaries in which any director, executive officer, greater than 5% stockholder of the Company or any other “related person” (as defined in Item 404 of Regulation S-K adopted by the SEC) has or will have a direct or indirect material interest. This approval requirement covers any transaction that meets the related party disclosure requirements of the SEC as set forth in Item 404, which currently apply to transactions (or any series of similar transactions) in which the amount involved exceeds $120,000.

Our Board has also adopted a special approval policy for transactions with MSG Distribution,and AMC Networks Inc. (“AMC Networks”) and their respective subsidiaries whether or not such transactions qualify as “related party” transactions described above. Under this

policy, the Independent Committee oversees approval of all transactions and arrangements between the Company no longer makes such tickets availableand its subsidiaries, on the one hand, and each of MSG and its subsidiaries and AMC Networks and its subsidiaries, on the other hand, in which the amount exceeds $120,000. To simplify the administration of the approval process under this policy, the Independent Committee may, where appropriate, establish guidelines for certain of these transactions.

Currently, and throughout our fiscal year ended June 30, 2017, our Audit Committee (which consisted solely of Class A Directors) served as the Independent Committee under the above policies. For a further discussion of the scope of these policies, see “Related Party Transaction Approval Policy.”

Other Committee Matters

Our Amended By-Laws permit the Board to form an Executive Committee of the Board which would have the power to exercise all of the powers and authority of the Board in the management of the business and

affairs of the Company, except as limited by the Delaware General Corporation Law. Our Board has not formed an Executive Committee, although it could do so in the future.

DIRECTOR COMPENSATION

The following table describes the components of our non-employee directors.non-management directors’ compensation program in

effect during the fiscal year ended June 30, 2017:

| | | | |

Compensation Element(1) | | Compensation |

Annual Cash Retainer | | $50,000 | | |

Annual Equity Retainer(2) | | $110,000 | | |

Annual Committee Retainer Fee | | $5,000 | | |

Annual Committee Chair Fee | | $10,000 | | |

Meeting Fees | | $2,000 per meeting (in person) $500 per meeting (by telephone) | | |

| (1) | A director who is a Company employee receives no compensation for serving as a director. |

| (2) | Each director receives an annual grant of restricted stock units determined by dividing the value of the annual equity retainer by the 20-trading day average closing price on the day prior to the annual meeting of our stockholders. Restricted stock units are fully vested on the date of grant but remain subject to a holding requirement until the first business day |

| following 90 days after service on the Board ceases (other than in the event of a director’s death, in which case they are settled as soon as practicable), at which time they are settled in stock or, at the Compensation Committee’s election, in cash. Such compensation is made pursuant to the Company’s 2010 Stock Plan for Non-Employee Directors, as amended, which was most recently approved by the Company’s stockholders on December 11, 2015 and is administered by the Compensation Committee. |

Director Compensation TableCommittee

The table below summarizes the total compensation paid to or earned by each person who served as a non-employee directors

Members: Messrs. Lhota, Litvin and Sykes (Chair)

Meetings during the fiscal year ended June 30, 2015. Directors who are employees of the Company receive no compensation for service as directors.2017: 10

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in Cash ($)(1) | | | Stock

Awards

($)(2)(3) | | | Option

Awards

($)(4) | | Non-Equity

Incentive Plan

Compensation

($) | | Change in

Pension Value and Nonqualified Deferred Compensation Earnings | | All Other

Compensation

(5) | | Total ($) | |

Charles F. Dolan | | | 60,500 | | | $ | 110,252 | | | — | | — | | — | | — | | | 170,752 | |

Charles P. Dolan | | | 57,000 | | | $ | 110,252 | | | — | | — | | — | | — | | | 167,252 | |

Kristin A. Dolan | | | 57,500 | | | $ | 110,252 | | | — | | — | | — | | — | | | 167,752 | |

Thomas C. Dolan | | | 55,500 | | | $ | 110,252 | | | — | | — | | — | | — | | | 165,752 | |

Deborah A. Dolan-Sweeney (6) | | | 28,500 | | | | 0 | | | — | | — | | — | | — | | | 28,500 | |

Marianne Dolan Weber (6) | | | 26,500 | | | | 0 | | | — | | — | | — | | — | | | 26,500 | |

Brian G. Sweeney | | | 61,000 | | | $ | 110,252 | | | — | | — | | — | | — | | | 171,252 | |

Wilt Hildenbrand | | | 61,000 | | | $ | 110,252 | | | — | | — | | — | | — | | | 171,252 | |

Richard D. Parsons (7) | | | 59,333 | | | $ | 110,252 | | | — | | — | | — | | — | | | 169,585 | |

Nelson Peltz (8) | | | 36,167 | | | $ | 110,252 | | | — | | — | | — | | — | | | 146,419 | |

Alan D. Schwartz | | | 91,500 | | | $ | 110,252 | | | — | | — | | — | | — | | | 201,752 | |

Scott M. Sperling (8) | | | 40,583 | | | $ | 110,252 | | | — | | — | | — | | — | | | 150,835 | |

Vincent Tese | | | 87,500 | | | $ | 110,252 | | | — | | — | | — | | — | | | 197,752 | |

(1) | These amounts represent retainer, committee and board meeting fees earned during the fiscal year ended June 30, 2015. The amounts reported do not include expenses incurred in attending meetings for which the Company reimburses each non-employee director for reasonable out of pocket expenses. |

(2) | This column reflects the grant date fair market value of 1,518 restricted stock units granted on December 18, 2014 to each non-employee director, as calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. |

(3) | For each non-employee director, the aggregate number of restricted stock units held as of June 30, 2015 is as follows: Charles F. Dolan, 18,489 units; Charles P. Dolan, 16,938 units; Kristin A. Dolan, 18,489 units; Thomas C. Dolan, 18,489 units; Deborah A. Dolan-Sweeney, no units; Marianne Dolan Weber, no units; Brian G. Sweeney, 18,489 units; Wilt Hildenbrand, 10,110 units; Richard D. Parsons, 1,518 units; Mr. Nelson Peltz, 1,518 units; Alan D. Schwartz, 18,489 units; Scott M. Sperling, 1,518 units; and Vincent Tese, 18,489 units. |